A single member LLC operating agreement puts key information about your LLC in writing. Many websites trying to sell you LLC forms and services will tell you that if you don’t have a solid single member LLC operating agreement you’ll lose protection. That is a complete lie.

Your asset protection depends on two things: your state’s LLC provisions and the separation of yourself and your single member LLC. Your operating agreement won’t change either of these—but it will come in handy for more mundane tasks, like opening a bank account.

- Single Member LLC Operating Agreement – Free Template

- Is a single member LLC operating agreement necessary?

- Should I have a single member LLC operating agreement?

- Start Your LLC Today!

- What should a single member LLC operating agreement include?

- How do single member LLCs maintain liability protection?

- Does FlutuxBusiness have any other LLC forms?

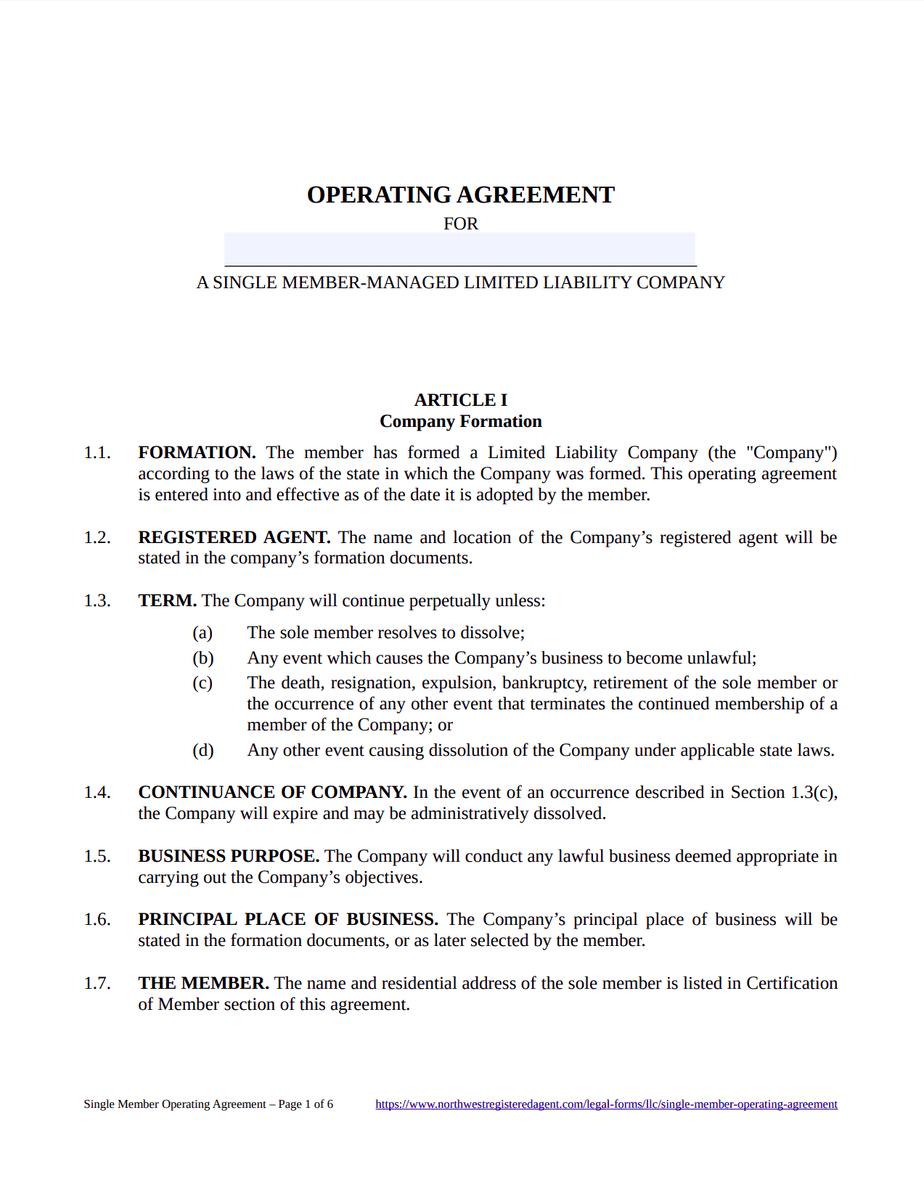

Single Member LLC Operating Agreement – Free Template

We’ve taken a lot of effort to simplify and minimize excess and obtuse language often found in single member LLC operating agreements. We created the minimalist’s single member agreement. You could easily fill out this form in less than 5 minutes. Like all our forms, this template is intended for individual use.

We also offer LLC operating agreement templates for specific types of LLCs, such as multi-member LLCs and manager-managed LLCs. Just like our single member LLC operating agreement, these templates are easy to complete and understand.

Multi-Member Operating Agreement

Manager-Managed Operating Agreement

Is a single member LLC operating agreement necessary?

An operating agreement is an internal document. So, unlike your Articles of Organization, you won’t have to submit this form to any state agency. However, your bank might require your operating agreement to open an account. Others you do business with might request to see it as well.

A common, fundamental misunderstanding about the single member LLC operating agreement is that this document bestows many more powers than it really does. In reality, your operating agreement won’t trump the law, regardless of what it says. So, you won’t lose your limited liability protection just because you don’t have an agreement. And, you won’t be able to skirt the law just because you say some dubious behavior (like using your business account as your personal piggy bank) is okay in your agreement.

Should I have a single member LLC operating agreement?

You might as well! It won’t hurt. If anything, taking a little bit of time to read through our operating agreement will help ensure you give proper consideration to initial steps (like contributions) and eventual possibilities (like dissolution). Your bank might want to see it, and it’s free, so you might as well have it. But please do yourself a favor and don’t pay a huge amount of money for a single member LLC operating agreement.

If you’re going to pay for something, pay for a service that will really benefit your LLC. We provide LLC registered agent service in every state. We provide online tools to help keep your LLC in compliance. We also form LLCs for $250 plus state fees.

Start Your LLC Today!

Don’t wait any longer! Now is the time to turn your entrepreneurial dreams into a reality. Start Your Business Today and take control of your future.

What should a single member LLC operating agreement include?

Your single member operating agreement should include information on contributions, bookkeeping, management, dissolution and more. Our free single member LLC operating agreement template covers the essential topics your LLC needs:

Article I: Company Formation

This first section of the single member LLC operating agreement basically serves 4 functions:

- Affirms that the LLC has been or will be formed with the state

- Lists key business information, including LLC name, registered agent, state, purpose and principal place of business

- Lists the situations that can end the business (and explains how the LLC can be continued)

- Explains how to add new members

Article II: Capital Contributions

Even though you’re the one creating your LLC, you still have to “buy in.” In other words, you’ll fund the LLC with money or other assets (initial capital contributions) in exchange for your ownership interest. You’ll list the total value of your contributions in this section.

Article III: Profits, Losses and Distributions

You’re in business to make money—this section explains how and when you get your money. Profits and losses are determined and allocated annually. After you pay expenses and any liabilities, you can make distributions at any time. If your company or membership interest is liquidated, distributions follow Treasury Regulations.

Article IV: Management

As the sole member, you run the show. This section spells out your powers (control, management, direction, operations, etc.) and your responsibilities (signing contracts, keeping records, etc.).

This article also notes that (assuming you’ve acted in good faith), you’re not personally liable for losses or damages to the LLC or expenses resulting from lawsuits or other actions against the LLC.

Article V: Compensation

Even though it might feel like you and the LLC are one and the same, it’s important to maintain a clear distinction. This article notes that if you incur an out-of-pocket expense or render a service to the LLC, you may be entitled to reimbursement or compensation.

Article VI: Bookkeeping

This section explains how you’ll keep financial records, including capital and distribution accounts. At the end of each calendar year, you’ll close the books and prepare a member statement (yes, it’s just for you, but these kinds of records are important).

Article VII: Transfers

Imagine a worst-case scenario where your LLC is sued by creditors—who are then awarded membership interest. This article states that such interest doesn’t include rights to participate in the management or operations of the LLC. Creditors would just get distributions (and only until the debt is paid off).

Article VIII: Dissolution

You can end your LLC whenever you want through the process of dissolution. This section notes that upon dissolution, the LLC is responsible for paying debts before making any distributions.

Certification of Formation

This is the signature page. You sign to acknowledge that you agree to abide by the terms of the operating agreement.

Exhibits

At the end of the single member operating agreement, there are also fill-in-the-blank exhibits. These exhibits include places for you to list your member information (your name, address and percent of ownership) and the details of your capital contributions.

How do single member LLCs maintain liability protection?

A single member LLC can lose its liability protection if the owner doesn’t maintain true separation from the LLC. Translation: if you are a single member LLC owner and pay for all your personal stuff out of the LLC’s checking account, you are opening yourself up to a judge possibly saying you and the LLC are the same entity.

No single member LLC operating agreement is going to save you if you use your LLC bank account to pay for personal items like entertainment, food, personal vacations, etc. If you use your LLC bank account as your personal piggy bank, you will lose your liability protection—even if you pay an attorney $5,000 for a fancy single member LLC operating agreement.

The best way to protect your assets from the actions of a single member LLC is to keep everything completely separate. It’s simple. Pay for personal things with your personal money. If the single member LLC has expenses, the single member LLC pays for those expenses out of the single member LLC checking account.

Does FlutuxBusiness have any other LLC forms?

We do! We have templates for meeting minutes, Articles of Organization and more. Or choose “LLC Forms” for a complete list of free forms we offer for LLCs.